In recent years, flexible packaging has taken over grocery store aisles, disrupting store shelves as well as the way we consume food and beverages. From baby food to salad dressing and even wine, food and drink items traditionally packaged in non-flexible packaging are changing their rigid ways and making the switch to flexible.

In recent years, flexible packaging has taken over grocery store aisles, disrupting store shelves as well as the way we consume food and beverages. From baby food to salad dressing and even wine, food and drink items traditionally packaged in non-flexible packaging are changing their rigid ways and making the switch to flexible.

What is the impact of brand owners and consumers shifting from non-flexible to flexible packaging? The Flexible Packaging Transition Advantages Study commissioned by the Flexible Packaging Association (FPA) aimed to find out.

Findings from this study build off FPA’s 2015 Brand Value Study, which determined consumers are willing to pay premium prices for product attributes enhanced by flexible packaging and confirmed packaging has a positive, documented impact on brand value.

The new study integrates insights from brand owners surveyed online in September 2016 by Packaging World and consumers surveyed online in September 2016 by Harris Poll.

Operational Benefits and Ability to Meet Consumer Needs are Key Motivators for Brand Owners who Transition to Flexible Packaging

Flexible packaging’s appeal to brand owners can be attributed to tangible benefits like enhanced operational efficiencies, increased sales, and meeting consumer needs.

Eighty-three percent of brand owners are already using flexible packaging, and survey findings suggest the trend of shifting to flexible will continue, as 58 percent of brand owners who have switched to flexible said they intend to use a higher mix of it in the next five years.

Among the brand owners surveyed who increased use of flexible packaging in some way, 57 percent were able to lower costs of production, and 49 percent improved supply chain efficiencies or lowered

cost of transportation. The survey additionally determined that brand owners who made the transition to flexible packaging were able to improve competitive positioning through consumer appeal (37%).

Flexible Packaging: A Fresh Take on Consumer Convenience

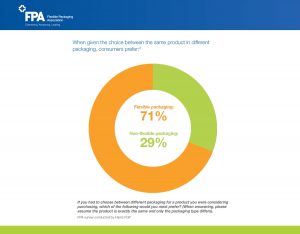

Consumers also recognize the benefits of flexible packaging, prefer it over non-flexible, and are willing to pay more for food stored in it. In fact, when given the choice between the same product in different types of packaging, 71 percent of consumers said they preferred flexible over non-flexible packaging.

Baby food now stored in squeezable pouches makes it easily transportable for parents running errands, single-use snack packaging is convenient for the busy professional, and microwaveable vegetable pouches are major timesavers for busy college students trying to get their daily serving of vegetables. The top benefits that consumers associate with flexible packaging versus non-flexible packaging are related to convenience.

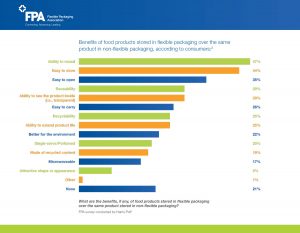

Attributes consumers indicated of food stored in flexible packaging include:

- Ability to reseal (47%)

- Easy to store (44%)

- Easy to open (35%)

- Reusability (29%)

The study also determined that 46 percent of consumers are willing to pay more for food stored in flexible packaging than for food stored in non-flexible packaging.

Additionally, snacks and salty snacks top the list of products consumers most want to purchase in flexible packaging instead of non-flexible packaging (61%), followed by cereal and breakfast products (44%).

Flexible Packaging is Expected to Experience Continued Growth

Insights from both packaging professionals and consumers suggest the flexible packaging industry will experience steady growth, continue to innovate, and outpace rigid packaging. Brand owners and consumers both see the value of and experience benefits with flexible packaging. Brand owners benefit from increased savings, improved sales and strong business results while also satisfying consumers’ needs for packaging that fits their lifestyles.

About the Studies

Packaging World Survey of Brand Owners

The Flexible Packaging Association commissioned Packaging World to conduct a cross-industry survey in September 2016. More than 200 packaging professionals were surveyed for the analysis, representing food and beverage, healthcare/pharmaceutical, personal care, consumer products, industrial, and other industries. Those surveyed represent package developers, package machinery engineers, procurement executives, brand managers, package designers, consultants and sales representatives. Respondents were surveyed about packaging use, preferences, and business impact.

To gather responses for this FPA survey conducted by Packaging World, three e-mail invitations were sent to the publication’s e-mail database. Respondents who identified themselves as packaging suppliers were filtered out of the results. This resulted in a net total of 201 product users for analysis.

FPA Survey Conducted by Harris Poll

FPA Survey Conducted by Harris Poll

This survey was conducted online within the United States by Harris Poll on behalf of G&S Business Communications from September 9-13, 2016 among adults ages 18 and older and from September 28-30, 2016 among 2,007 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

FPA Brand Value Study

The FPA Brand Value Study integrates primary research of consumers, brand owners, and industry members, plus input from secondary research into one study. The data includes insights from brand owners surveyed online in August 2015 by Packaging World, insights from consumers surveyed online in September 2015 by Harris Poll, and insights from FPA members interviewed by G&S Business Communications in 2015.

Source: Flexible Packaging Association

You must be logged in to post a comment Login